With MSPs at Holyrood recently announcing plans to potentially replace Stamp Duty on properties sold in Scotland under the Land and Buildings Transaction Tax (Scotland) Bill (LBTT), we take a look at how this might impact sellers and buyers after 2015, when the change in the system is set to take place and The Scottish Parliament will be given control over property tax.

The current system is administered by the UK Treasury and sees tax paid on the whole value of properties which are sold for more than £125,000. The new plan involves changing the current “slab rate” tax brackets to a “progressive charge” depending on the value of the property.

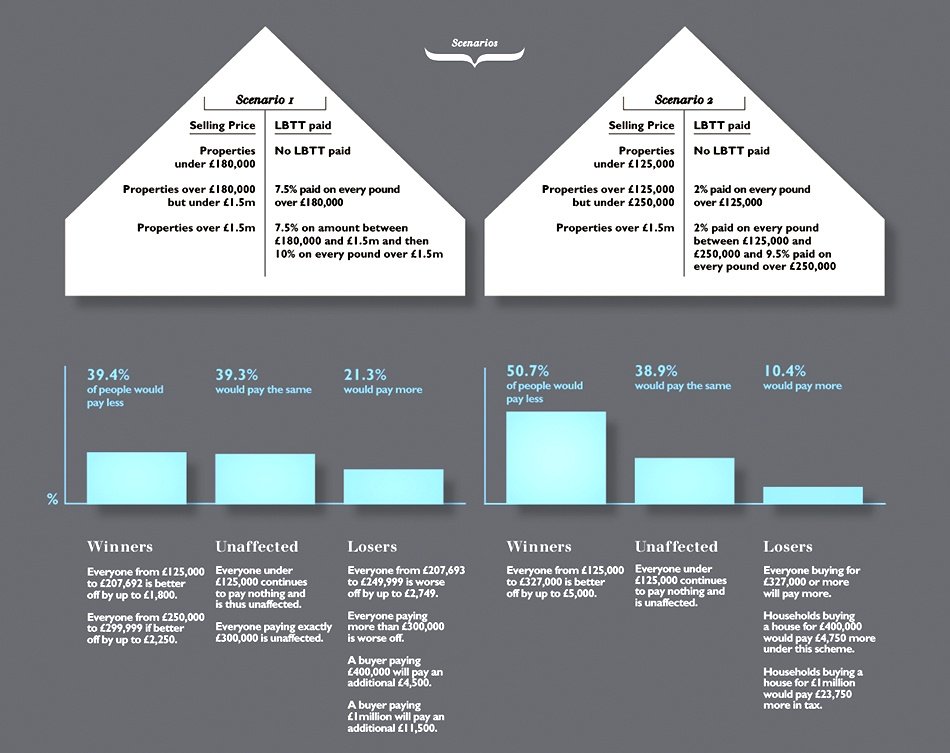

MSPs have come up with two possible scenarios under the new system. The first scenario proposes Stamp Duty paid on all properties sold at over £180,000 at a rate of 7.5% paid on every pound over £180,000 and 10% on every pound over £1.5m. The second scenario proposes that Stamp Duty is paid on all properties sold at over £125,000 at a rate of 2% paid on every pound over £125,000 and 9.5% paid on every pound over £250,000.

Calculating whether either proposal will benefit the majority of home buyers has yet to be concluded.

However, either scenario may be a welcome replacement to the current ‘slab’ structure that has been criticised for creating inequalities in the level of taxation paid, particularly around the tax thresholds, where a difference in selling price of £1 can lead to an extra tax burden in the thousands of pounds. The new proposed progressive system of taxation will be more reflective of the total value of the home being sold and could see an end to the inefficiencies in the market arising from the current Stamp Duty system.

The LBTT may also help first time buyers to get on the property ladder given that evidence from the most recent Stamp Duty holiday suggests it did not greatly assist first time buyers to enter the property market given that high deposit requirements usually remain the single biggest obstacle for this group.

Share on facebook

Share on facebook Tweet article

Tweet article